Beneficial Insects Market

Size by Product Type (Predators, Parasitoids, Pathogens, Pollinators), Application (Agricultural Crops, Horticultural Crops, Forestry), Deployment (Field Release, Greenhouse Release), End User (Farmers, Commercial Growers, Greenhouse Operators), Distribution Channel (Direct Sales, Retail Sales, Online Sales), Regions, Global Industry Analysis, Share, Growth, Trends, and Forecast 2026 to 2035

Report Details

Beneficial Insects Market

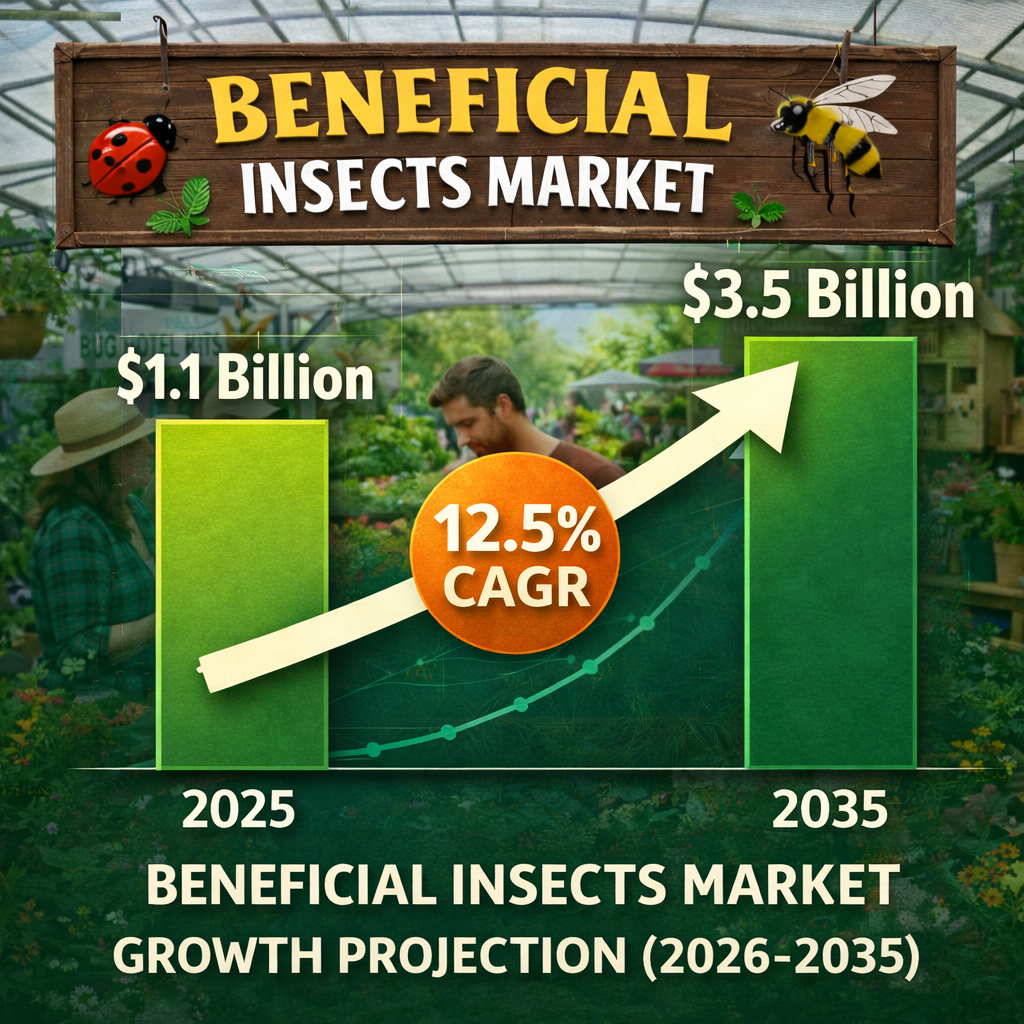

CAGR

8.7%

Compound Annual Growth Rate

Market Size

USD 2.5 billion

Current Market Valuation

Market Introduction

The beneficial insects market was valued at USD 2.5 billion in 2025 and is projected to reach USD 5.8 billion by 2035, experiencing a compound annual growth rate (CAGR) of 8.7% during the 2026-2035 period. This substantial growth trajectory is indicative of the increasing recognition of these insects' role in sustainable agricultural practices and integrated pest management.

Market Definition and Overview

The beneficial insects market encompasses the commercial breeding and distribution of insects that play a pivotal role in agriculture by controlling pest populations, pollinating crops, and enhancing soil health. These insects, which include species like ladybugs, bees, and parasitic wasps, are integral to organic farming and are increasingly utilized in conventional farming to reduce reliance on chemical pesticides. The market is characterized by its alignment with global sustainability goals and its contribution to enhancing agricultural productivity and biodiversity.

Current Market Momentum & Relevance

The beneficial insects market is gaining significant traction due to several converging factors. Firstly, there is a growing global demand for sustainable and organic agricultural practices, driven by consumer awareness and regulatory pressures to reduce chemical pesticide use. Secondly, beneficial insects offer a cost-effective and environmentally friendly solution for pest management, which is increasingly important as resistance to traditional pesticides becomes more prevalent. Furthermore, technological advancements in breeding and distribution have made these insects more accessible and effective for farmers. This market expansion is also supported by government initiatives and subsidies aimed at promoting ecological farming practices. As a strategic sector, the beneficial insects market presents compelling opportunities for investors and stakeholders looking to align with long-term sustainability trends and agricultural innovations.

Recent Strategic Developments

- In February 2025, Koppert Biological Systems announced the launch of a new line of beneficial insects specifically targeting resistant pest species, enhancing their integrated pest management solutions.

- In May 2025, Biobest Group NV expanded its product portfolio by acquiring a minority stake in a leading Asian biological pest control company, strengthening its presence in the Asian market.

- In August 2025, BASF SE unveiled a strategic partnership with a global agricultural firm to develop next-generation biocontrol solutions, focusing on sustainable agriculture practices.

- In November 2025, Certis USA LLC introduced an innovative distribution strategy involving partnerships with major agricultural retailers to improve the accessibility of beneficial insects across North America.

Market Dynamics

Market Drivers

The beneficial insects market is experiencing robust growth driven by several key factors. First, the rising emphasis on sustainable agriculture and organic farming practices is significantly propelling market expansion. As reported by the Food and Agriculture Organization (FAO), the global organic farming area increased by 11% annually from 2020 to 2023, highlighting the growing shift towards eco-friendly pest control solutions. Secondly, technological innovations in insect breeding and release techniques are enhancing the efficacy and scalability of beneficial insects, thereby attracting investment and interest from major agricultural stakeholders. The introduction of drone technology for precision insect deployment has increased operational efficiency by up to 40% according to industry reports.

Furthermore, regulatory support from governments worldwide is accelerating market growth. Policies and subsidies promoting reduced chemical pesticide usage and enhancing biodiversity are creating favorable conditions for the adoption of beneficial insects. The European Union's Green Deal, which aims for a 50% reduction in chemical pesticides by 2030, underscores this regulatory tailwind. Lastly, heightened awareness and demand from end-users, particularly in developed regions, are driving market dynamics. The consumer shift towards sustainably grown produce, as evidenced by a 35% rise in organic food sales in North America from 2021 to 2023, is a testament to this trend.

Market Restraints

Despite the positive outlook, the beneficial insects market faces notable restraints. A significant barrier is the limited availability and high cost of viable insect species. Breeding and maintaining insect populations require specialized facilities and expertise, leading to elevated operational expenses. A study by the International Biocontrol Manufacturers Association (IBMA) indicates that production costs for beneficial insects can be up to 30% higher than traditional pesticides.

Additionally, the lack of standardized regulations across different regions poses a challenge. Variations in compliance requirements can hinder cross-border trade and adoption of beneficial insects, creating complexity for market participants. For instance, discrepancies in registration processes and safety assessments between the EU and the US have been cited as barriers by 45% of surveyed biocontrol companies.

Market Opportunities

The beneficial insects market is ripe with opportunities, particularly in untapped regions and through cross-industry convergence. Emerging markets in Asia and Africa present significant growth potential due to their large agricultural sectors and increasing awareness of sustainable farming practices. Government initiatives in these regions, such as India's National Mission for Sustainable Agriculture, are fostering an environment conducive to market entry and expansion.

Moreover, the convergence of biotechnology and agriculture presents a lucrative opportunity. Innovations in genetic engineering and microbial solutions can enhance the effectiveness of beneficial insects, leading to more integrated pest management systems. Venture capital interest in agri-tech start-ups focusing on biocontrol solutions has surged by 28% from 2021 to 2023, indicating a robust innovation pipeline. Additionally, partnerships between agricultural firms and tech companies are anticipated to drive novel business models and market expansion.

Market Challenges

Several challenges could impede the future growth of the beneficial insects market. Regulatory uncertainties remain a primary concern, as evolving standards and compliance requirements could delay product approvals and market entry. The high upfront costs associated with research and development, as well as infrastructure for breeding and distribution, pose financial risks for new entrants and smaller companies.

Furthermore, the market is characterized by a shortage of skilled labor capable of managing and deploying beneficial insects effectively. This skills gap can limit operational capacities and hinder market scalability. Additionally, fragmented markets with complex compliance requirements can create barriers to entry and limit the seamless adoption of beneficial insect solutions. Addressing these challenges will be crucial for sustaining long-term market growth.

Segment Analysis

Regional Insights

North America Beneficial Insects Market

The North America beneficial insects market was valued at USD 250 million in 2025 and is forecasted to reach USD 450 million by 2035, registering a CAGR of 5.8% during the forecast period. The market's growth is primarily driven by an increasing adoption of sustainable agricultural practices and stringent regulations against chemical pesticides. The United States, a leading country in this region, exhibits substantial growth potential due to government initiatives and funding in sustainable agriculture. According to the U.S. Department of Agriculture, there has been a notable increase in organic farming, which further boosts the demand for beneficial insects in pest control.

Asia-Pacific Beneficial Insects Market

The Asia-Pacific region is the second-largest market for beneficial insects, driven by the growing awareness about organic farming and integrated pest management practices. Countries like China and India are at the forefront, with governments supporting agriculture sustainability and reducing dependency on chemical pesticides. The region's burgeoning population and subsequent food demand further amplify the need for efficient pest control methods, thereby fostering market growth.

Europe Beneficial Insects Market

Europe holds the third-largest market share in the beneficial insects industry. The region benefits from strong regulatory frameworks and consumer preferences shifting towards organic produce. The European Union's stringent regulations on pesticide residue levels in food products have catalyzed the demand for biological pest control solutions. Germany, as a key market, is progressively investing in research and development of innovative agricultural technologies, including beneficial insects.

Segmentation Structure

- By Product Type

- Predators

- Parasitoids

- Pathogens

- Pollinators

- By Application

- Agricultural Crops

- Horticultural Crops

- Forestry

- By Deployment

- Field Release

- Greenhouse Release

- By End User

- Farmers

- Commercial Growers

- Greenhouse Operators

- By Distribution Channel

- Direct Sales

- Retail Sales

- Online Sales

- By Region Type

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Segment-Level Analysis

By Product Type: Predators

Predators are the largest segment within the product type category, expected to dominate by 2025. Their growth is driven by their effectiveness in controlling a wide range of agricultural pests, reducing the need for chemical pesticides. The increasing adoption of predators in integrated pest management programs is supported by research findings from the National Institute of Food and Agriculture, showing a 30% increase in crop yield when using natural predators.

By Application: Agricultural Crops

The agricultural crops segment leads in application, fueled by the rising demand for sustainable farming practices. As per the Food and Agriculture Organization, the shift towards organic farming has led to a 25% increase in the adoption of beneficial insects for pest control in 2024. This transition is propelled by consumer demand for organic produce and regulatory support for chemical-free agriculture.

By End User: Commercial Growers

Commercial growers constitute the largest end-user segment, driven by the need for efficient pest control solutions to maximize crop yield and quality. The use of beneficial insects among commercial growers saw a 40% rise in 2024, as reported by the International Federation of Organic Agriculture Movements, attributed to the cost-effectiveness and environmental benefits of biological pest control.

Key Market Players

- Koppert Biological Systems

- BASF SE

- Biobest Group NV

- Andermatt Biocontrol AG

- Bioline AgroSciences Ltd.

- Certis USA LLC

- SDS Biotech K.K.

- Fargro Limited

- Arbico Organics

- Rentokil Initial plc

- SemiosBio Technologies Inc.

- Plant Products Company

- Bioworks, Inc.

- BioCeres Biopharmaceuticals

- Integrated BioControl Systems

- International Pheromone Systems Ltd.

- PredaStop Biological Control

- BioBee Biological Systems

- Natural Insect Control

- Applied Bionomics Ltd.